What is the Gold-Silver Ratio?

The Gold-Silver Ratio (GSR) is a simple calculation used by investors to determine the relative value between the two most popular precious metals. It represents the number of ounces of silver required to purchase a single ounce of gold.

To calculate it, use this formula:

Price of Gold ÷ Price of Silver = GSR

Why the Ratio Matters

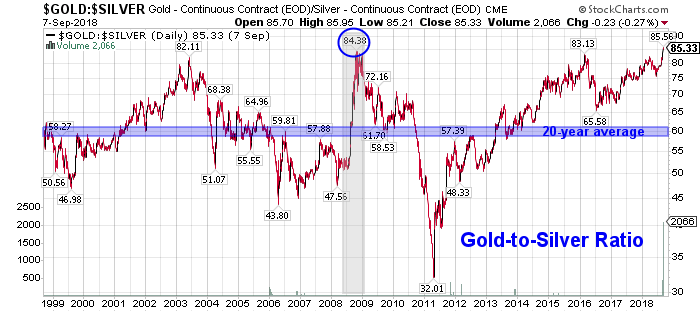

Investors use the ratio as a mean-reversion tool to decide when to swap one metal for the other.

-

High Ratio (e.g., 80:1+): Silver is historically “cheap” compared to gold. This is often seen as a signal to buy silver.

-

Low Ratio (e.g., 30:1-): Gold is becoming “cheaper” relative to silver. This is often a signal to trade silver back into gold.

Case Study: Turning Silver into Gold

Many investors use silver as leverage to increase their total gold holdings over time. Here is how a strategy of buying at a 40:1 ratio can quadruple your gold if the ratio hits 10:1.

1. The Initial Investment (Ratio 40:1)

Imagine you have the capital to buy 1 ounce of Gold. However, the current ratio is 40:1. Instead of buying the gold, you purchase 40 ounces of Silver.

2. The Market Shift (The Move to 10:1)

A 10:1 ratio is possible during periods of extreme industrial silver demand or high inflation. Because the silver market is smaller and more volatile than gold, it tends to move much faster during bull runs. While both metals might go up in price, silver “outruns” gold, narrowing the gap.

3. The Great Swap

Once the ratio hits 10:1, you trade your silver for gold.

| Asset | Initial State (40:1 Ratio) | Final State (10:1 Ratio) |

| Silver Owned | 40 oz | 40 oz |

| Gold Value | 1 oz | 4 oz |

The Result: By “playing the ratio,” you ended up with 400% more gold than you started with, simply by waiting for the relative values to shift.

Is a 10:1 Ratio Possible?

While the modern average sits between 50:1 and 80:1, a 10:1 ratio is grounded in two facts:

-

Geology: Silver is found in the Earth’s crust at a ratio of roughly 15:1 to 19:1.

-

History: For centuries, the ratio was legally fixed at 15:1 or 16:1. In a supply-squeeze scenario, silver could easily return to its “natural” geological rarity.